Wind and solar capacity will double over the next five years globally and exceed that of both gas and coal, according to a new International Energy Agency (IEA) report.

The Paris-based intergovernmental agency anticipates a 1,123 gigawatt (GW) increase in wind and solar that would mean these power sources overtake gas capacity in 2023 and coal in 2024.

The IEA’s Renewables 2020 report concludes that while other fuels have struggled due to Covid-19 this year, the market for renewables has proved “more resilient than previously thought”.

The continued growth of wind and solar means renewables, including hydro and bioenergy, would displace coal as the largest source of the world’s power by 2025, says the IEA’s report.

Last year, Carbon Brief analysis of the IEA’s data found that it only expected renewables to overtake coal output over the next five years under its more optimistic “accelerated case” scenario.

However, this year – even in its less ambitious “main case” scenario – wind, solar, hydro and biomass are projected to take the lead within the next five years.

Capacity milestones

Renewables are set to dominate the construction of new power infrastructure in the coming years as costs continue to fall.

In its main case, the IEA has wind, solar, hydro and other renewable sources accounting for 95% of the increase in the world’s electricity generating capacity over the next five years.

Solar capacity, which the IEA recently described as offering – in the best cases – the “cheapest…electricity in history”, is set to be the key driver of this trend.

In the new report’s main scenario, 130GW of solar will be added each year between 2023-2025 and this rises to 165GW in the accelerated scenario, which would account for nearly 60% of the total renewable expansion across this period.

Wind is also expected to expand considerably, but its contribution will be smaller than solar.

Overall, in the IEA’s main scenario, wind and solar capacity is set to double between 2020 and 2025. The chart below shows this, as well as what the IEA calls two “milestones” when solar and wind combined overtake, in turn, gas and coal capacity.

Total installed power capacity by source during 2010-2025, according to IEA “main case” forecasts. The “accelerated case” for wind and solar is shown with a dashed line. Source: IEA Renewables 2020. Chart by Carbon Brief using Highcharts.

This increase in capacity means renewable generation will expand by almost 50% over the next five years, pushing their share of electricity generation to a third and, as IEA executive director Dr Fatih Birol puts it, “ending coal’s five decades as the top power provider”.

Overall, renewable electricity generation by this point will be nearly 9,745 terawatt hours (TWh) – “equivalent to the combined demand of China and the European Union”, according to the agency.

As power demand goes up around the world to accommodate economic growth and increasingly electrified societies, the IEA expects renewables to meet virtually all of this increase.

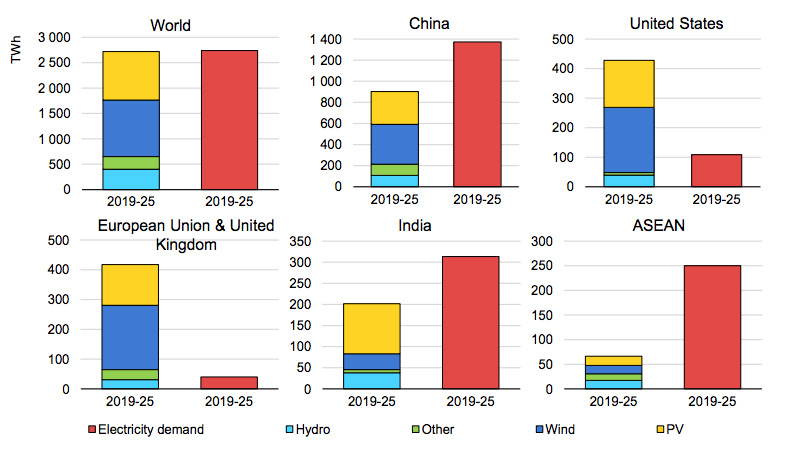

Its report forecasts renewables meeting 99% of the increase in electricity demand over the next five years. This can be seen in the chart below.

In the US and Europe, renewable increases are expected to far exceed demand as they are brought in to replace ageing fossil fuel infrastructure.

However, in Asian nations renewables will only cover some of the future demand, with the remainder covered by fossil fuels.

‘Defying Covid’

Global energy demand is set to decline by 5% in 2020 due to Covid-19 and electricity demand by 2%. The IEA has previously noted that the crisis is accelerating the closure of older fossil fuel infrastructure.

However, according to the report, electricity generated by wind, solar, hydro and biomass is expected to increase by 7% globally in 2020.

While the pandemic has had an impact on the renewable sector, the report notes that “the fundamentals of renewable energy expansion have not changed”. Falling costs and policy support mean they are continuing to grow.

Construction activity continued even during lockdowns in many countries and manufacturing has ramped back up quickly, even after initial delays. This has allowed the sector to “defy Covid” and set a new record for renewable capacity additions in 2020, the IEA says.

According to Birol, in a press release accompanying the report:

“The resilience and positive prospects of the sector are clearly reflected by continued strong appetite from investors – and the future looks even brighter with new capacity additions on course to set fresh records this year and next.”

The IEA’s main case scenario sees a record-breaking 198GW increase in renewable capacity this year, rising as high as 234GW in the accelerated case.

This is largely the result of developers in China and the US rushing to take advantage of incentives that expire at the end of the year.

Next year, Europe and India are expected to lead a “renewables surge” driven by “green recovery” funding and renewable energy targets for the former, with a large number of delayed projects coming online in the latter.

Future uncertainties

While the renewables sector has done relatively well this year, the expiration of existing incentives and resulting uncertainties mean that the IEA expects a small decline in the rate of capacity additions in 2022, compared to 2021, unless policies are changed.

The key policies coming to an end are China’s offshore wind and solar subsidies, as well as the solar and onshore wind production tax credits in the US.

“Renewables are resilient to the Covid crisis but not to policy uncertainties,” says Birol.

On the other hand, the report also notes that recent policy momentum has the potential to give renewable energy use “an extra boost”.

Recent weeks have seen China, South Korea and Japan all come forward with net-zero pledges that will require the phasing out of coal power and a significant uptick in renewables.

The recent presidential election victory for Joe Biden in the US, who has pledged a $2tn spending programme for clean energy, could also have a significant impact on the renewables sector.

“If the proposed clean electricity policies of the next US administration are implemented, they could lead to a much more rapid deployment of solar PV and wind, contributing to a faster decarbonisation of the power sector,” says Birol.